2021 Year-End Tax Tips for Business Owners

-Jeff-Allan-qFizxsLBnz7HtcGDZ.png)

2021 Year-End Tax Tips for Business Owners

Now that we’re approaching the end of the year, it’s time to review your business finances. We’ve highlighted the most critical tax-planning tips you need to know as a business owner.

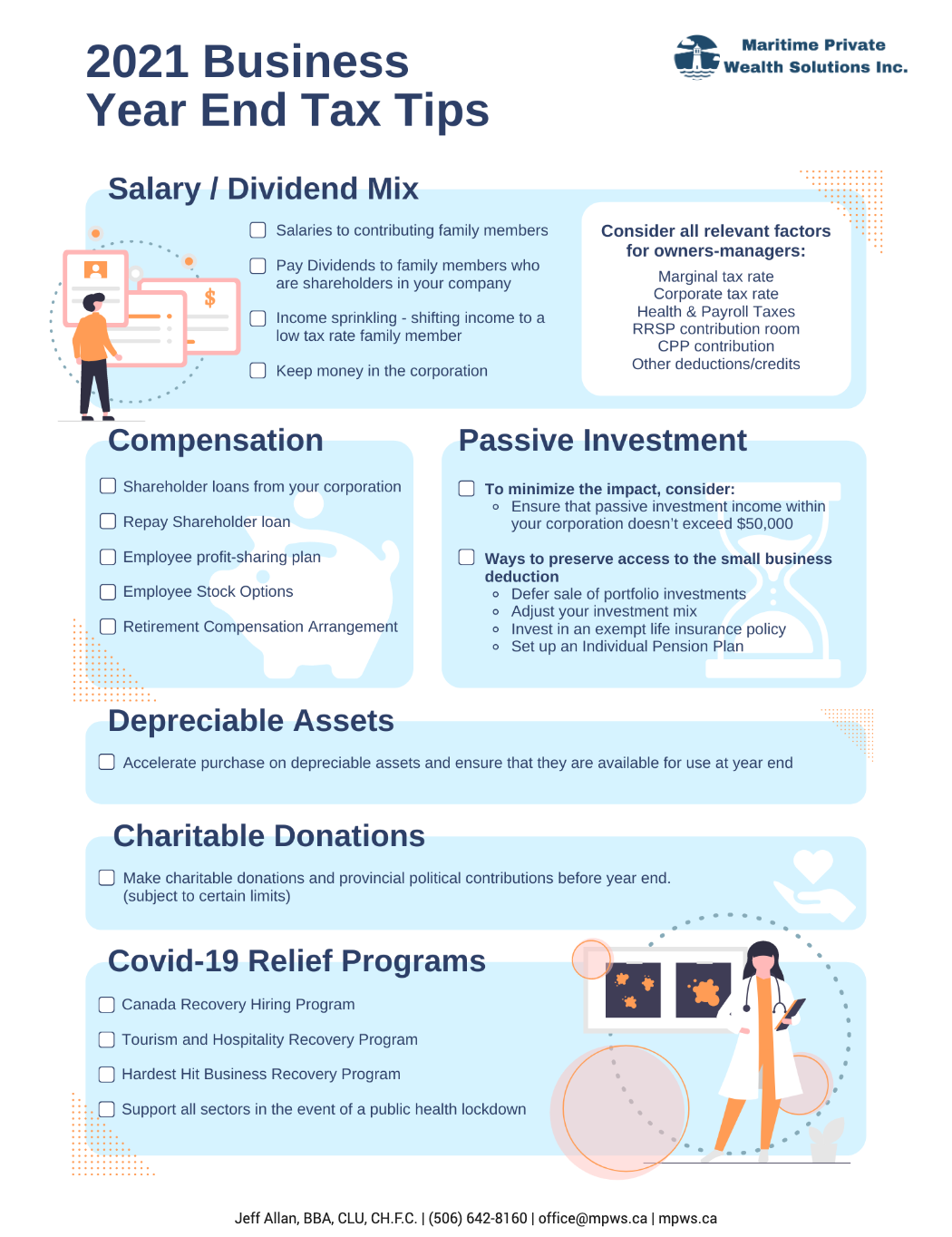

Salary and Dividend Mix

As a business owner, one essential part of tax planning is determining the right mix of salary and dividends for both yourself and your family members.

The following are the main options you can consider when determining how to distribute money from your business:

-

Pay a salary to family members who work for your business and are in a lower tax bracket – This enables them to declare an income so that they can contribute to the Canada Pension Plan (CPP) and a Registered Retirement Savings Plan (RRSP). You must be able to prove the family members have provided services in line with the amount of compensation provided.

-

Pay dividends to family members who are shareholders in your company – The amount of dividends someone can receive without paying income tax on them will vary depending on the province or territory they live in.

-

Distribute money from your business via income sprinkling – This is shifting income from a high-tax rate individual to a low-rate tax individual. However, this strategy can cause issues due to Tax On Split Income (TOSI) rules. A tax professional can help you determine the best way to “income sprinkle” so none of your family members are subject to TOSI.

-

Keep money in the corporation if neither you nor your family members need cash – Taxes can be deferred if your corporation retains income and the corporation’s tax rate is lower than your personal tax rate.

No matter what strategy you take to distribute money from your business, keep in mind the following:

-

Your marginal tax rate as the owner-manager.

-

The corporation’s tax rate.

-

Health and payroll taxes.

-

How much RRSP contribution room do you have.

-

What you’ll have to pay in CPP contributions.

-

Other deductions and credits you’ll be eligible for (e.g., charitable donations or childcare or medical expenses).

Compensation

An important part of year-end tax planning is determining appropriate ways to handle compensation. The following are the main things to consider:

-

Can you benefit from a shareholder loan? A shareholder loan is an agreement to borrow funds from your corporation for a specific purpose. The interest from the loan may be deductible if the proceeds of the shareholder loan were used to produce income from business or property.

-

Do you need to repay a shareholder loan to avoid paying personal income tax on the amount you borrowed?

-

Is setting up an employee profit-sharing plan a better way to disburse business profits than simply paying out a bonus?

-

Keep in mind that when an employee cashes out a stock option, only one party (the employee OR the employer) can claim a tax deduction on the cashed-out stock option.

-

Think about setting up a Retirement Compensation Arrangement (RCA) to help fund you or your employee’s retirement.

Passive Investments

One of the most common tax advantages available to Canadian-Controlled Private Corporations (CCPC) is the Small Business Deduction (SBD).

For qualifying businesses, the SBD reduces your corporate tax rate. Keep in mind that the SBD will be reduced by five dollars for every dollar of passive investment income over $50,000 your CCPC earned the previous year.

The best way to avoid losing any of the SBD is to make sure that the passive investment income within your associated corporation group does not exceed $50,000.

These are some of the ways you can make sure you preserve your access to the SBD:

-

Defer the sale of portfolio investments as necessary.

-

Adjust your investment mix to be more tax efficient. For example, you could choose to hold more equity investments than fixed-income investments. Only 50% of the gains realized on shares sold is taxable, but investment income earned on bonds is fully taxable.

-

Invest excess funds in an exempt life insurance policy. Any investment income earned on an exempt life insurance policy is not included in your passive investment income total.

-

Set up an individual pension plan (IPP). An IPP is like a defined benefit pension plan and is not subject to the passive investment income rules.

Depreciable Assets

Another tactic you should consider for year-end tax planning is to hasten your purchase of any depreciable assets. A depreciable asset is a type of capital property that you can claim the Capital Cost Allowance (CCA) on.

These are two of the best ways to make the most of tax planning with depreciable assets:

-

Make use of the Accelerated Investment Incentive. With this incentive, some depreciable assets are eligible for an enhanced first-year allowance.

-

Purchase equipment such as zero-emissions vehicles and clean energy equipment eligible for a 100 percent tax write-off.

Donations

Another essential part of tax planning is to make all of your donations before year-end. This applies to both charitable donations and political contributions.

For charitable donations, you need to consider the best way to make your donations and the different tax advantages of each type of donation. For example, you can:

-

Donate securities.

-

Give a direct cash gift to a registered charity.

-

Use a donor-advised fund account at a public foundation. A donor-advised fund is like a charitable investment account.

-

Set up a private foundation to solely represent your interests.

We can help walk you through the tax implications of each of these types of charitable donations.

Make the Most of Covid-19 Relief Programs

While some COVID-19 relief programs, such as the Canada Emergency Wage Subsidy (CEWS) and Canada Emergency Rent Subsidy (CERS) have ended, others are still available. See if your business can benefit from any of the following relief programs:

-

Canada Recovery Hiring Program (CRHP). This program will continue to run until May 2022. If your business is eligible and continues to experience a decline in revenues as compared to pre-pandemic levels. In that case, the CRHP will provide support to assist in hiring new staff or increasing the wages of your existing staff.

-

Tourism and Hospitality Recovery Program. This new program provides wage and rent support to eligible businesses such as hotels and restaurants with an average monthly revenue reduction of at least 40% over the first 13 qualifying periods for the CEWS and a current month revenue loss of at least 40%.

-

Hardest Hit Business Recovery Program. This provides rent and wage support of up to 50% for eligible entities. Eligible entities must meet two conditions – an average monthly revenue reduction of at least 50% over the first 13 qualifying periods for the CEWS and a current month revenue loss of at least 50%.

-

General support in the event of a public health lockdown. If there is a public health lockdown and your business loses sufficient revenue, your business would be eligible for support at the same subsidy rates as the Tourism and Hospitality Recovery Program.

-

Know what’s included as taxable income. If you received assistance from the government assistance programs, including the CEWS, CERS, and CRHP, this assistance is taxable as income.

Get year-end tax planning help from someone you can trust!

We’re here to help you with your year-end tax planning. Book some time with us today to learn how you can benefit from these tax tips and strategies.