When should I buy life insurance?

When should I buy life insurance?

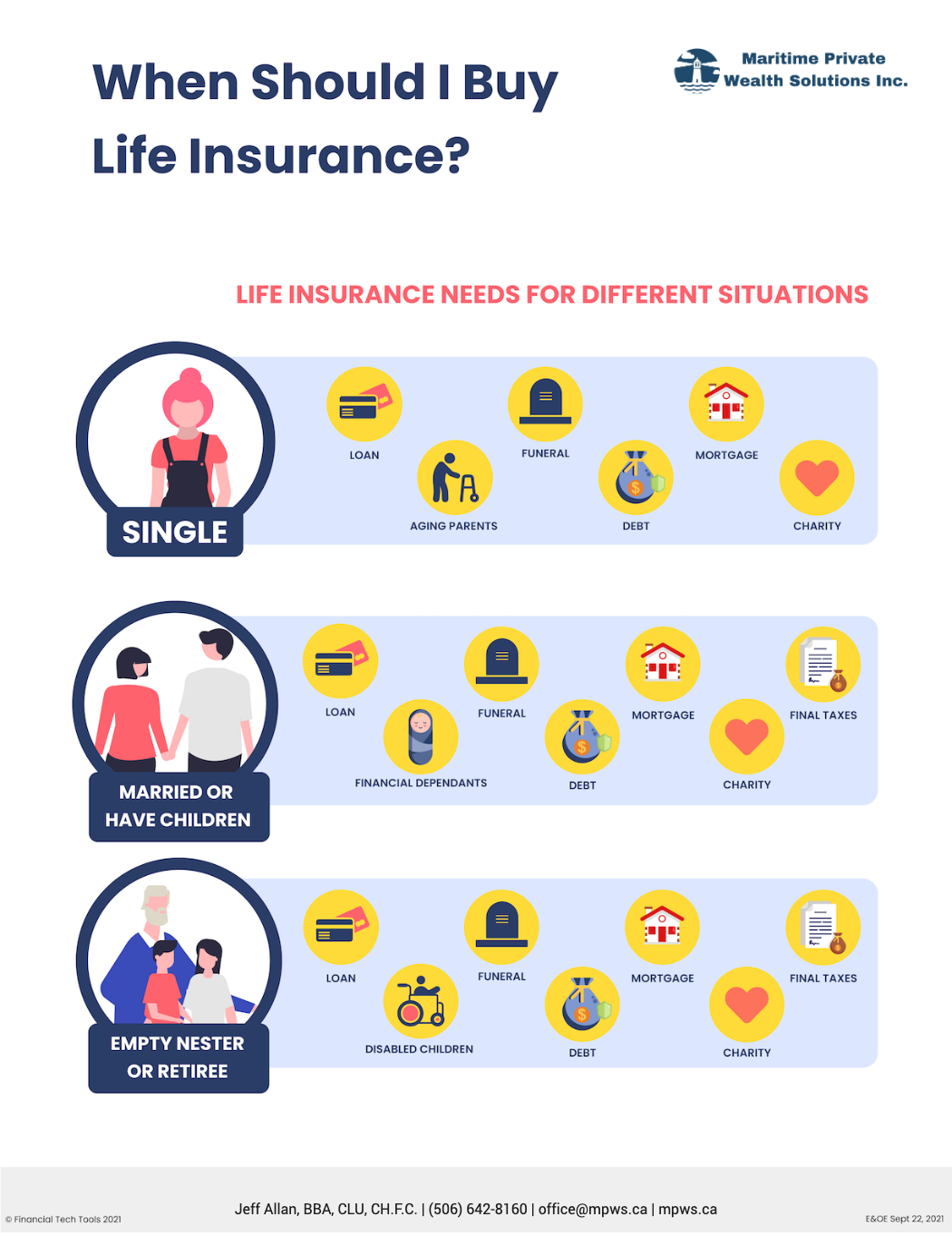

Life insurance can benefit you no matter what stage of life you’re at. It’s never too soon or too late to buy life insurance. Not only will it give you peace of mind, but it will also provide your loved ones with financial support after you die.

Types of life insurance

There are two main types of life insurance:

-

Term life provides temporary coverage for a set amount of time (for example, 10, 15, or 20 years).

-

Permanent coverage is life insurance that never expires.

Term life is generally cheaper as it is only good for a set amount of time. Permanent insurance will cost you more in the short run but may work out less expensive in the long run as your premiums do not tend to increase as you age.

Life insurance in your 20s

In your 20s, you may feel like you’re immortal and have lots of other things you want to spend your money on. But you also likely have responsibilities – such as student loans your parents may have co-signed for or a mortgage with your partner. If something happened to you, your loved ones would be left alone to pay for that debt. Life insurance could help fill this financial gap.

Also, another great reason to get life insurance in your 20s is that it’s very affordable! You will have a low insurance premium because you are considered low risk.

Life insurance in your 30s

By the time you’re in your 30s, you may have several financial responsibilities – including a mortgage and children. If you’ve only had term insurance up to this point, you may want to consider converting it to permanent to help give yourself lifelong protection.

Even if you have life insurance through your workplace, you may want to buy additional life insurance. Separate life insurance can help cover you if you lose your job or lock-in rates while you are relatively young and healthy.

Life insurance in your 40s, 50s, 60s and beyond

At this stage in your life, you may still have a mortgage or dependent children. You may have even bought a cottage or a vacation property. No matter your financial responsibilities, if your estate doesn’t have enough cash to cover them, it’s essential to have life insurance still.

Now is an excellent time to lock in permanent insurance. However, if you find the premiums too high or know you only need life insurance for a set amount of time, term life may still work for you.

Your next steps

Now you know about the two main types of life insurance and why it’s crucial to have it, no matter what age you are. If you’re not sure where to go from here, contact your insurance advisor or us – we can help you figure out your next steps!